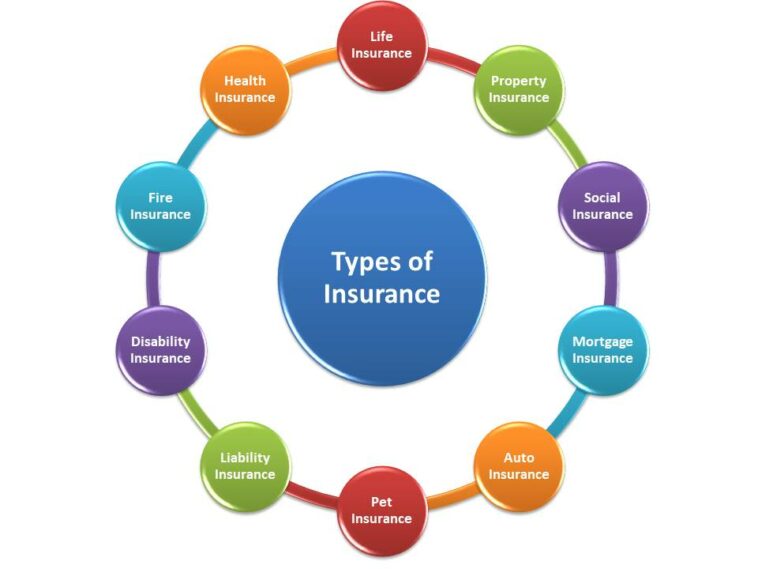

Whether you have a home, business, or personal car, you need to make sure that you have proper insurance coverage. There are a number of different types of insurance, such as life, home, and professional liability. You can also look into purchasing political risk insurance if you are involved in a political campaign.

Life insurance

Buying life insurance is a good way to protect your loved ones. It can help with funeral costs, critical illness, and end-of-life expenses. It can also help replace lost income. It is a relatively inexpensive option.

Life insurance is a legal contract between the insurer and the policy holder. The insurer promises to pay a sum of money to the designated beneficiary after the insured person dies. Generally, the premium is not tax deductible. The death benefit can be used to pay off debts and pay for end-of-life expenses.

The amount of coverage depends on the type of life insurance and the length of time the policy has been in force. The cash value of the policy increases over time. If the insured borrows money from the policy, the total coverage will be reduced. The policy may also be nullified if the insured intentionally misrepresents information on the application.

You can purchase life insurance for yourself, your spouse, or your children. Often, parents want to buy a moderate-sized policy for their children when they are young to help secure their future insurability. It is a good idea to review your policy periodically to ensure that your needs are met.

There are many different types of life insurance, and it can be difficult to choose the right one. A whole life or a term life policy are two common types. Some policies have special riders that are included in the base premium.

Other options include permanent life insurance, which offers strong guarantees. It may also build up cash value. It can also be used to cover your mortgage.

Finally, you can also purchase a risk-sharing plan that will help cover your dependents’ financial needs. If you have a child who is still in school, you can purchase a life insurance policy that will help them go to college.

While life insurance is a useful product, it is important to remember that the cost of the policy can vary depending on your family’s risk level and the amount of coverage you purchase. The cost of a policy can also be affected by the state in which you live.

Home insurance

Getting homeowners insurance is a way to protect your property. It also gives you liability protection in case someone is injured on your property. It can pay for medical bills and legal expenses if you are found to be at fault.

Different types of policies offer different levels of coverage. Some provide replacement cost coverage, while others will pay for depreciation on your home. You should always check your policy to make sure you have enough coverage to replace your home.

Your home will need to be insured for at least 80% of its actual value to be adequately covered. You may need to purchase additional riders if you want to ensure your home is covered against higher risks.

Standard homeowners policies do not include damage caused by floods, earthquakes or acts of war. They also do not cover damages due to wear and tear or neglect. Some companies will require you to insure your home for the full replacement cost.

Depending on your insurance company, you can purchase replacement cost, open perils or actual cash value coverage. If you have any questions about your policy, you can contact your insurer for a quote. You can also get quotes from online comparison sites.

You can increase your liability protection with a personal umbrella policy. If you have a lawsuit, this type of coverage can pay for court costs and lost wages. It will also protect your financial assets if you are found to be at fault.

You can also find discounts on your home insurance policy. Some companies may offer discounts for having a home alarm system or bundling your policies. You can also get a discounted rate if you have a claim free history. You should also check to see if the company is financially stable.

The amount of coverage you need for your home will depend on the age, construction and condition of your home. If you rent your home, you may need more protection. You can also buy special coverage if you live in an area that is prone to disasters.

Professional liability insurance

Unlike general liability insurance, professional liability insurance (also called errors and omissions insurance, or E&O) is designed to protect professionals against liability resulting from errors and omissions in their work. However, the coverage limits will vary depending on your business.

Typically, a professional liability insurance policy will cover damages that are incurred as a result of a wrongful act that occurs during the period of the policy. This includes claims that arise from past services and work performed anywhere in the world.

The amount of professional liability insurance you need depends on several factors, including the size of your business, the profession you perform, and the risk level of your business. The cost of this type of insurance ranges from about $500 to $1,000 per year. The cost of this insurance can be relatively low when compared to other related expenses.

The best way to determine the right coverage for your business is to compare policies from various providers. The policy that will meet your needs is the one that is tailored to your business.

Choosing a policy that has higher limits than just the indemnity is a smart move. You may also want to consider purchasing defense costs in addition to your policy limit. This will help you minimize the financial impact of any lawsuit. In most cases, defense costs will be a very high proportion of any claim settlement.

There are many different forms of professional liability insurance. Fortunately, many of these policies offer defense coverage in addition to their policy limit.

Some of the most common types of professional liability claims include negligent omissions, intentional acts, and bodily injury. There are many more types of coverage, and you will need to consult with a professional liability insurance lawyer to decide what type of coverage is best for your business.

While a lawsuit is always an expense, it is especially costly when the case is filed without merit. The cost of defending a case can stretch for years.

Although the cost of a professional liability insurance policy will depend on the risks your business poses, a policy is a wise investment.

Political risk insurance

Typically, political risk insurance is used by multinational corporations to protect against losses from political events. For example, a company could be forced to shut down its plant in a developing country, or lose the rights to manufacture an automobile. In both cases, political risk insurance would provide coverage for the cost of government confiscation, expropriation, and other costs associated with these types of events.

A political risk insurance policy is not required, but it can provide protection against many of the most damaging political risks. It can be obtained from private or public sources.

Political risk insurance can be purchased by businesses of any size. The cost of a political risk insurance policy depends on the type of risk that is insured and the insurer that is chosen. It is often purchased by banks, large exporters, and international contractors.

Aon’s political risk programmes help mitigate the financial and legal consequences of political risk. Aon’s experts can assess your business and identify any potential political risks, and design and implement risk management programmes to meet your needs.

The geopolitical landscape today is more tumultuous than ever before. The US-China trade war is just one of several geopolitical risks in the global marketplace. There are also interstate conflicts, outbreaks of nationalism, and failures of national governance. These risks can wreak havoc on your business, reducing the value of your assets and affecting your profitability.

Aon’s political risk programs are designed to help your business avoid disruption, and to facilitate your operations. You can choose to purchase a single-country policy, or extend it to multiple countries. You can also take advantage of Aon’s portfolio manager to monitor your exposure to political risk.

Companies who work overseas are at greater risk of exposure to political risk. These risks include a loss of income, business interruption, and the disruption of supply chains.

The exact meaning of “political action” is not always clear, but it can include government actions, terrorism, and other events. These can affect the economy, industries, and local products. Some of these events, such as an embargo or sanctions, can have a significant impact on a company’s cash flow.